The Unity Campaign and the Credit Café: A Perfect Pairing

Learn More About IHA's Participation In This Year's Unity Campaign!

IHA is proudly participating in the Unity Campaign for Frederick County, running from March 6th to 20th, 2024.

But what exactly is the Unity Campaign?

The Unity Campaign stands as a joint effort, bringing together nonprofit partners, sponsors, and the broader Frederick community in a collaborative donation campaign. This annual event, held every March, operates entirely online, ensuring easy accessibility for all. Moreover, every individual donation made during this campaign goes directly to the nonprofit of your choice. (And we're certainly hoping you'll choose Interfaith Housing Alliance, or "IHA.")

So, why should you consider contributing to the Unity Campaign?

All the participating nonprofits within the campaign provide vital support to ALICE (Asset Limited, Income Constrained, Employed) households. These are families earning incomes above the Federal Poverty Level but still grappling with affording essential household needs such as housing, transportation, childcare, food, and healthcare. Shockingly, the most recent ALICE report discovered that 36% of households in Frederick County, MD fall into this category. This statistic underscores the urgency of our collective support. It's entirely conceivable that someone you know—perhaps a friend, neighbor, or colleague—is part of an ALICE household and could greatly benefit from your generosity.

Curious to delve deeper into ALICE? Follow this link to learn more: https://www.unitedwayfrederick.org/challenge-ALICE

How to Donate?

There are two ways to donate:

Visit this website: https://fundraise.givesmart.com/vf/Unity2024/team/InterfaithHousing

Text Unity202418 to 71777

Can’t donate? No problem, please help spread the word about IHA’s Unity Campaign participation!

How will IHA utilize Unity Campaign Contributions?

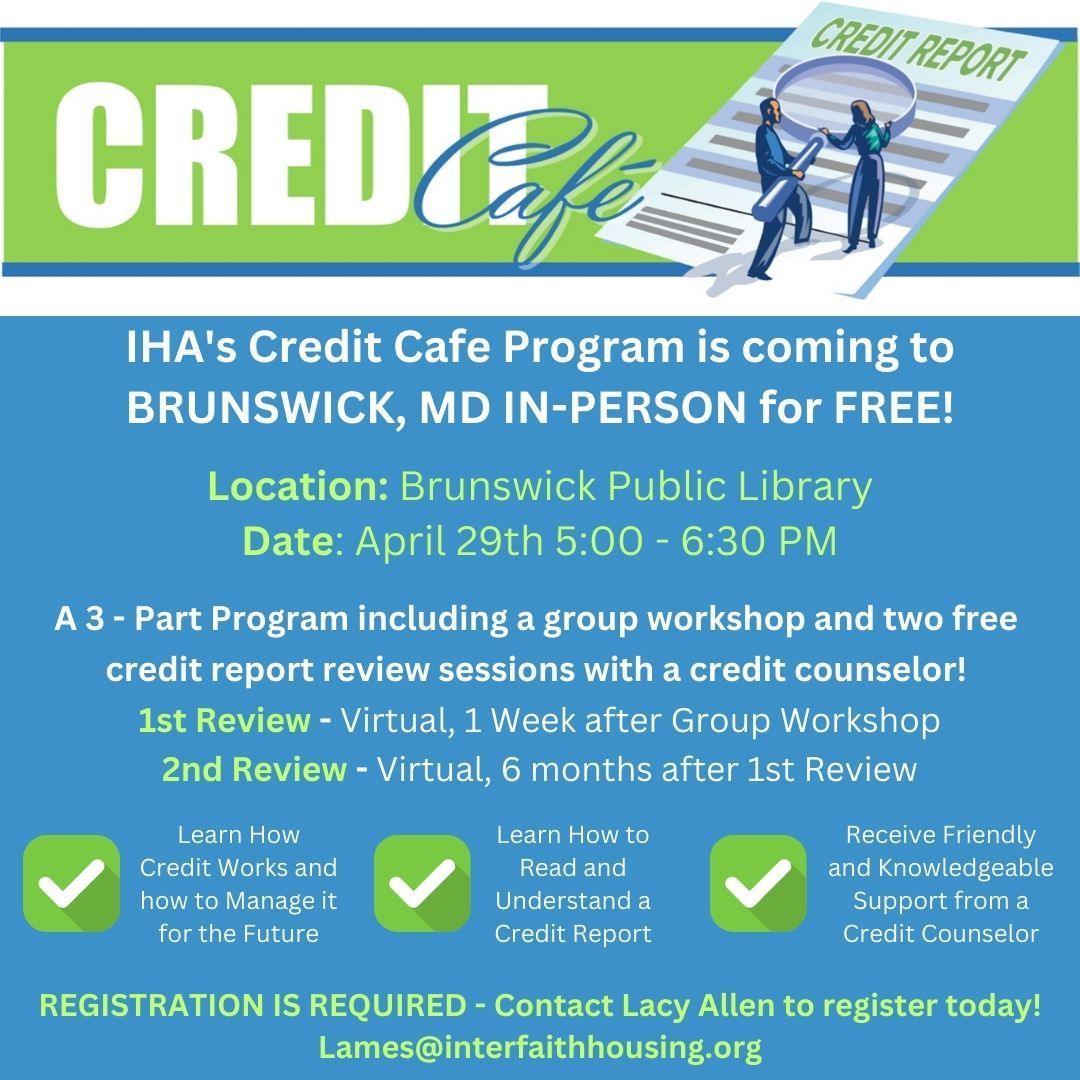

Through the Unity Campaign, donations will directly support IHA's Credit Café Workshop. This workshop operates on a principle of inclusivity, offering its services entirely free of charge to all participants seeking assistance in enhancing their credit scores. With just $67, we can cover the expenses of providing two credit reports per attendee.

How does the Credit Café Workshop by IHA benefit ALICE households?

In today's world, an individual's credit standing influences various aspects of life, whether it's renting an apartment, applying for loans, seeking employment, or managing utility services. The Credit Café Workshop equips participants with invaluable knowledge to effect lasting, positive changes in their credit and financial decision-making. These changes empower participants to attain greater financial stability for themselves and their families, enabling them to access better housing, secure loans at lower interest rates, and pursue improved job opportunities. Most importantly, the transformative impact of the Credit Café Workshop mitigates the necessity for ALICE households to constantly confront difficult financial choices concerning their day-to-day expenses.

During the last fiscal year, July 1, 2022 – June 30, 2023, IHA served 145 individuals whose average yearly household income was approximately $33,795. To date in this fiscal year, July 2023 – June 2024, IHA has already served 79 individuals whose average yearly household income is approximately $36,652.

How does the Credit Café Workshop operate?

The Credit Café Workshop offers a comprehensive approach, blending education with strategic credit goal setting to aid participants in improving, maintaining, or enhancing their credit scores while reducing overall debt burdens. The workshop unfolds in two key phases:

Educational Workshop: This initial phase consists of a one-hour group session offered multiple times each month throughout the year. Participants delve into a wide range of topics covering the fundamentals of credit mechanisms and best practices for its upkeep.

Personalized Credit Report Review: Following the group workshop, participants engage in a tailored 30-minute one-on-one session with an advisor, conducted virtually within one week of the group workshop. During this session, the advisor assists participants in understanding their credit reports and devising credit-related goals aligned with their future financial aspirations. Each participant receives a complimentary personal copy of their tri-merged credit report, freshly pulled on the day of the event to ensure the most current information for this individualized meeting.

Continued Support: The Credit Café Workshop provides ongoing assistance to participants beyond their initial workshop attendance. Advisors remain accessible to participants as needed, following up via email, phone calls, or text messages based on the participant's preference at 3 and 6-month intervals. These check-ins aim to ensure participants have the necessary resources to sustain their credit journey and to monitor progress. Participants are then invited back for a follow-up advising session and an updated copy of their credit report.

Moreover, the Credit Café Workshop is currently offered entirely in a virtual format, with some hybrid options emerging. Additionally, IHA offers interpretation services at no cost to participants, with interpreters available on-demand in over 240 languages.

Interested in the Credit Café Workshop? Contact Lacy Allen at lames@interfaithhousing.org or text 301-818-5606 to get started today!